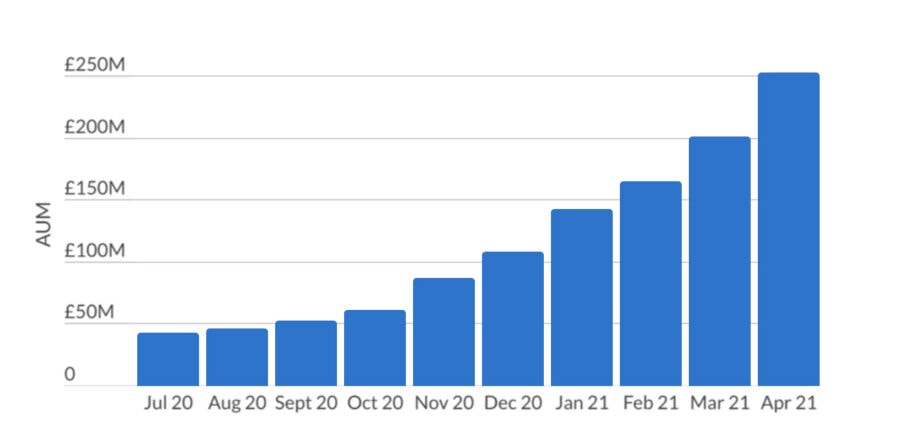

Betafolio smashes through £250m AUM milestone

13/05/2021 - Betafolio

Betafolio, the low cost, fixed-fee, high-tech turnkey model portfolio service, now has over £250m in AUM, thanks to record inflows from UK advisers.

This remarkable team only took ten months to get to the first £100m, three months to get to the second £100m and just one month to get to the next £50m!

Betafolio’s ever-enthusiastic CEO, Abraham Okusanya, explains: “In my days as a consultant, I used to deride providers for going on about assets, like it’s their own. But now I get really excited by it. This money represents the hopes and dreams of some 800 individuals/families. We are humbled to have been entrusted by their advisers to help them look after it.”

Unbelievably, thus far Betafolio has had no dedicated sales team – until they welcomed Joe Kerr into the business in April this year. Joe is well known and respected in the industry, having most recently been part of the team at Cofunds and Aegon, before joining Betafolio.

Abraham muses: “The big lesson for me, from all this, is don’t just criticise, compete!

“For years, I railed against expensive discretionary MPS on platforms. I said it could be done at a flat fee or for a single digit basis point. But, until we came to the market with a real alternative proposition for advisers, it felt like I was just screaming to an empty sky.

“Turns out, some advisers were listening. They agree with us, that it’s ludicrous that a typical MPS service charges 0.30% for what amounts to an IP on asset allocation. And that, with great technology, we can do it for less than a third of the average price (9bps)! So, once again, thanks to those advisers who backed our course and voted with their client assets.”

He summarises: “I have learnt that it’s much more productive to compete, than to criticise or complain.”

Visit the Betafolio website to find out more about the UK’s premier turnkey asset management provider (TAMP), offering: a flat-fee, low-cost, evidence-based, discretionary model portfolio service (MPS) exclusive to financial planning firms.

All articles on this news site are submitted by registered contributors of EssexWire. Find out how to subscribe and submit your stories here »